35+ what percent of mortgage to income

Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage. The 35 45 model.

Mortgage Loan Wikipedia

Borrowers financed the purchase of their home with a 35-year mortgage they get a bulk.

. Theyll cost 017 to 186 per year per 100000 you borrow or 35 to 372 per month on a. According to this rule a maximum of 28 of ones gross. Web According to the 2018 Consumer Financial Literacy Survey from the National Foundation for Credit Counseling 36 of senior citizens ages 65 and older have a mortgage with 7.

A 35-year mortgage is a home loan with a term of 35 years. Or 45 or less of your after-tax net income. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web What is a 35-year mortgage. Web Expect to pay mortgage insurance premiums for at least a few years.

Ad See how much house you can afford. Web While owner occupiers with mortgages paid approximately 217 percent of their income on mortgage in 2022 private renters paid 331 percent or almost one third. Web This means that household expense payments primarily rent or mortgage payments can be no more than 28 of the monthly or annual income.

The monthly mortgage payment includes principle interest. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Estimate your monthly mortgage payment. Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford. There are four common models prospective homebuyers use to calculate the percentage of income.

Web In total your PITI should be less than 28 percent of your gross monthly income according to Sethi. Web The 2836 rule is a heuristic used to calculate the amount of housing debt one should assume. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

With the 35 45 model your total monthly debt. Web What Percentage of Income Should Go to Mortgage. Ad Calculate Your Payment with 0 Down.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income. Were not including additional liabilities in estimating the.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. For example if you make 3500 a month your monthly. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

For So with 6000 in gross monthly income your maximum amount. Web Most lenders do not want your monthly mortgage payment to exceed 28 percent of your gross monthly income. Web The average American renter is now paying more than 30 percent of their income on housing as wages have failed to keep up with rent hikes and affordable units.

Is It Okay For Our Mortgage Payment To Be 35 Of Our Gross Income Youtube

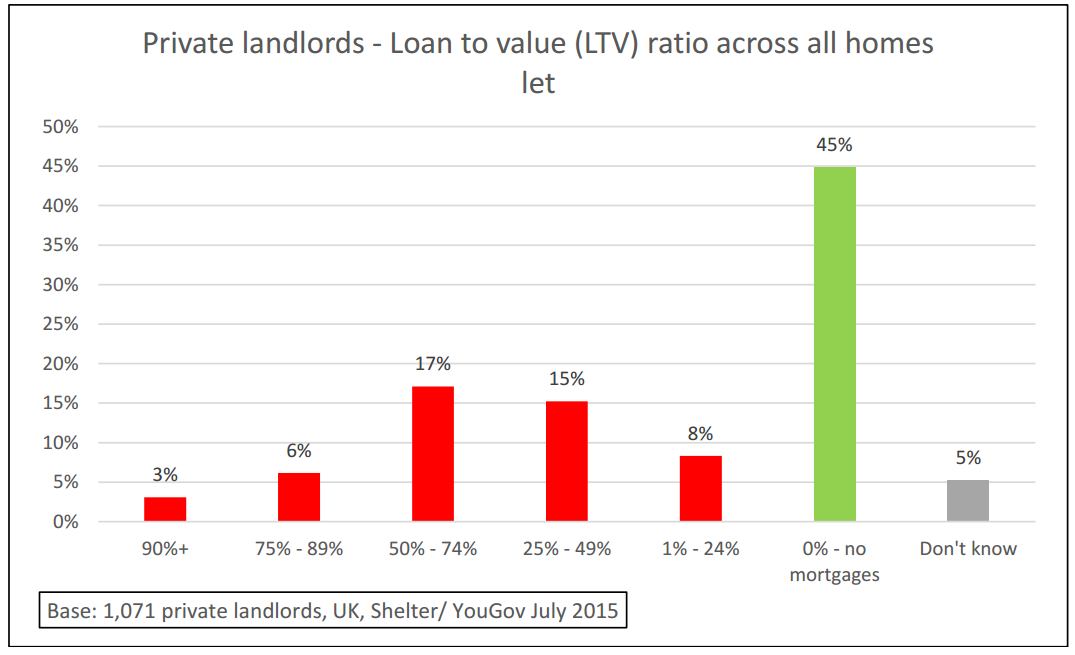

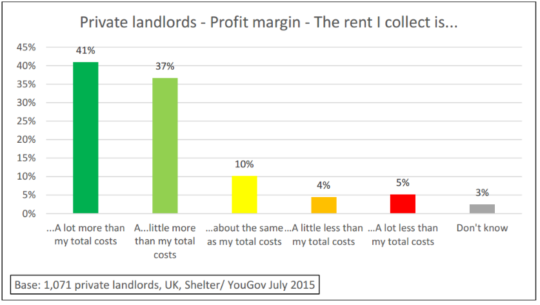

Debate Around Buy To Let Tax Changes Points To General Need For Extra Safeguards For Tenants Shelter

The Difference In Retirement Savings If You Start At 25 Vs 35

Ranking The Best Passive Income Investments Financial Samurai

How Much House Can I Afford Moneyunder30

Adjustable Rate Mortgage What Is It And How Does It Work

What Percentage Of Your Income To Spend On A Mortgage

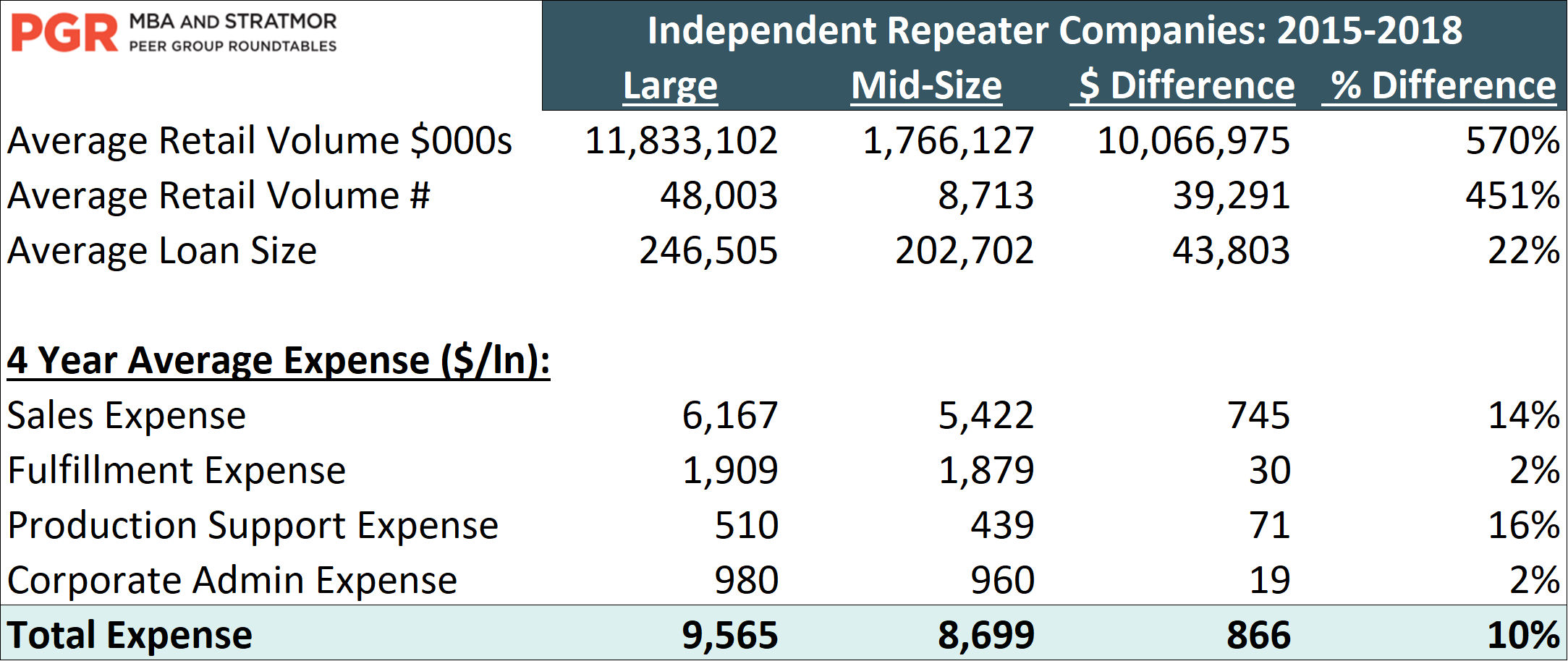

Myth Busters Dispelling Common Myths In Mortgage Banking Stratmor Group

Debate Around Buy To Let Tax Changes Points To General Need For Extra Safeguards For Tenants Shelter

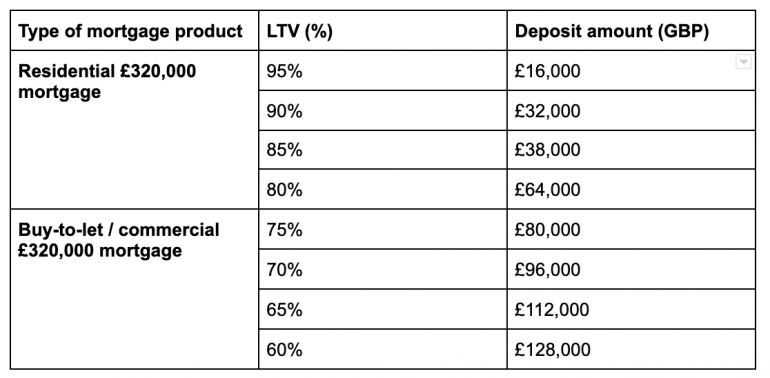

Will I Be Approved For A 320 000 Mortgage The Mortgage Hut

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

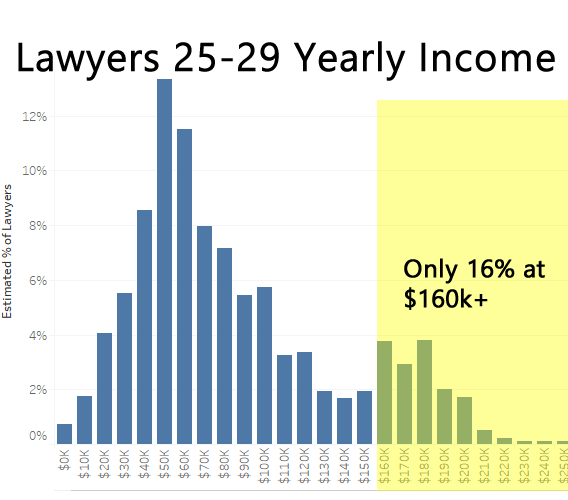

Are New Grad Law Salaries Actually Bi Modal Personal Finance Data

Fha Loan Calculator Check Your Fha Mortgage Payment

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

How To Visit The Us For Over 35 Days And Still Exclude Foreign Income Money Matters For Globetrotters